At the end of each financial year it is worth clarifying the rules that relate to assets acquired during the year. Which acquisitions will qualify for an outright deduction and which need to be capitalised and depreciated? With a number of changes over the past few years, such clarification is worthwhile.

The confusion arises in part due to different rules applying to different taxpayer entities, and whether that entity is carrying on business, and in part due to the different immediate asset write-off thresholds (e.g. <$300 or <$1,000 or <$20,000).

Question 1: Are you carrying on a business?

(a) No

Common situations where an entity is not carrying on a business include an individual deriving salary/wage income, or an entity (such as an individual, trust or company) that holds passive investments (such as, holding shares or a rental property).

Where the entity is not carrying on business the rules that apply when buying assets are as follows:

Immediate Write-off/Deduction: $300 or less

An immediate deduction for assets costing $300 or less is available for certain assets used mainly to produce non-business assessable income. The deduction is not available for any assets used mainly in carrying on a business. Broadly, the following four tests need to be met:

- The cost of the depreciating asset is $300 or less.

- You use the asset mainly for the purpose of producing assessable income that is not income from carrying on a business.

- The asset is not part of a set of assets you start to hold in the income year that costs more than $300.

- The asset is not one of a number of identical or substantially identical assets you start to hold in the income year that together costs more than $300.

The ATO website has more information of each of the above, including examples.

Depreciation

If you are not eligible to claim the immediate deduction, you generally work out any deduction under the depreciation rules based on the assets effective life.

Taxpayers will also be able to take advantage of the low value/low cost rules.

Low-cost Asset vs Low-value Assets: less than $1,000

The ATO provides the following descriptions for low-cost and low-value assets:

‘A low-cost asset is a depreciating asset whose cost is less than $1,000 (after GST credits or adjustments) at the end of the income year in which you started to use it, or had it installed ready for use, for a taxable purpose.

A low-value asset is a depreciating asset:

- that is not a low-cost asset;

- that has an opening adjustable value for the current year of less than $1,000 (worked out using the diminishing value method), and

- for which you used the diminishing value method to work out any deductions for decline in value for a previous income year.’

Assets with a cost under $300 cannot be added to the low value pool (as these would be immediately written-off).

Under the Uniform Capital Allowance (UCA) rules, an entity can allocate both low-cost assets and low-value assets to a low-value pool. If a taxpayer elects to use a low value pool all low-cost assets must be allocated to the pool, while low-value assets can be allocated to the pool.

Assuming assets allocated to the low-value pool are wholly used by the taxpayer for income producing purposes then the depreciation is calculated as:

- For the income year in which the low-cost asset is first allocated to the pool – the depreciation is calculated at a rate of 18.75% (or half the pool rate); and

- For other years (i.e. where the asset has been held in the pool for a full year) the depreciation is calculated at the pool rate (currently 37.5%).

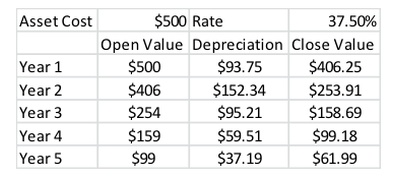

For example, for an asset costing $500 the depreciation expense would be as follows:

(b) Yes

Where the entity is carrying on a business, the entity should determine whether they qualify for the simplified depreciation rules.

Question 2: Where you are carrying on a business, are you a small business?

(a) Yes

If an entity is an eligible small business entity (that is, it has an aggregated annual turnover of less than $2 million) it can choose to use the simplified depreciation rules.

According to the ATO website: ‘It is not necessary to specifically elect to be an eligible small business each year in order to access the concessions. However, you must assess your eligibility for the concessions each year.’

If the choice is not made, then the normal UCA rules apply (see 2(b) below). Where the choice to use the simplified depreciation rules is made the following rules apply:

Immediate Write-off/Deduction: $20,000 or less

Generally, an immediate deduction is available for assets costing less than $1,000. However, there is currently a temporary measure in place where an immediate deduction is available for assets costing less than $20,000. To qualify, the assets must:

- first be acquired at or after 7.30pm AEST of 12 May 2015, andfirst used or installed ready for use on or before 30 June 2017.

- Click here for more information on the above rules from the ATO website.

Depreciation

If an entity has chosen to use the simplified depreciation rules, but the entity cannot immediately write off the assets as per the above, then the assets are allocated to a small business asset pool.

Assuming assets allocated to the small business pool are wholly used by the business for income producing purposes then the depreciation is calculated as:

- For the income year in which the assets are first allocated to the pool – the depreciation is calculated at a rate of 15% (or half the pool rate); and

- For other years (i.e. where the asset has been held in the pool for a full year) the depreciation is calculated at the pool rate (currently 30%) on the opening balance of the pool.

If the pool balance is below $20,000 as at the end of the year (before taking into account any depreciation) the balance can be written off in that year.

The ATO website has more information on these rules.

Low-cost Asset vs Low-value Assets: less than $1,000

Due to the immediate write-off available to small business for assets costs under $1,000 no depreciation rules are required for the pooling and depreciation of such assets.

(b) No

Where the entity is NOT a small business the following rules apply:

Immediate Write-off/Deduction: Not Applicable

For entities carrying on business but who do not qualify for the simplified depreciation rules (see below) there is no value under which an asset can be immediately written off.

Depreciation

For all assets the depreciation is calculated based on the asset’s effective life. If an asset has an effective life of 5 years and is being written off on a straight line basis, the annual depreciation expense for would calculated at 20% of the asset cost.

Low-cost Asset vs Low-value Assets: less than $1,000

Business taxpayers are also generally able to apply the specific rules dealing with low cost or low value assets (as referred to at 1(a) above).