There are a number of benefits to taking out a life insurance policy via an industry superannuation fund. These include a default level of coverage (generally without having to provide evidence of health) and it is often cheaper than the same level of coverage outside of super. However, this needs to be weighed up against the tax treatment.

The payment of a life insurance policy taken out in the insured’s name (i.e. not via a superannuation fund) will generally be tax free. In contrast, the tax treatment of a life insurance policy paid by a superannuation fund depends on whether the beneficiary is a “death benefits dependant” or not.

The main definition of death benefits dependant for taxation law is found in section 302-195(1) of the Income Tax Assessment Act 1997 (“ITAA 1997”) which provides:

A death benefits dependant of a person who has died, is:

- the deceased person’s *spouse or former spouse; or

- the deceased person’s *child, aged less than 18; or

- any other person with whom the deceased person had an interdependency relationship under section 302-200 just before he or she died; or

- any other person who was a dependant of the deceased person just before he or she died.

The payment of a lump sum death benefit that includes life insurance proceeds to a death benefits dependant will be entirely tax free (section 302-60 ITAA 1997).

If the insured individual does not have any death benefits dependants then the amount will be paid to non-dependants. Individuals typically not having death benefits dependants are young single people just starting out in the workforce.

Superannuation benefits paid to non-death benefits dependants of the deceased will, like all superannuation payments, consist of both tax free and taxable components. Usually the taxable component is only comprised of an “element taxed in the fund” but when the superannuation fund claims a deduction for the cost of insurance premiums, it will also include an “element untaxed in the fund”. The formula used to calculate these taxed and untaxed elements of the taxable component is found in section 307-290 ITAA 1997 which reads as follows:

(2) The * taxable component of the * superannuation lump sum includes an element taxed in the fund worked out as follows:

(a) first, work out the amount under the formula in subsection (3);

(b) next, reduce that amount (but not below zero) by the tax free component (if any) of the superannuation lump sum.

(3) For the purposes of paragraph (2)(a), the formula is:

Amount of Service days

*superannuation lump sum × Service days + Days to retirement

“days to retirement” is the number of days from the day on which the deceased died to the deceased’s * last retirement day.

“service days” is the number of days in the * service period for the lump sum.

(4) The element untaxed in the fund of the * taxable component is the balance of the taxable component.

The effect of this formula is that the younger a person is when they die, the higher the proportion of the “element untaxed in the fund” (which is taxed at a much higher maximum of 30% under subsection 302-145(3) ITAA 1997) and the lower the proportion of the “element taxed in the fund” (which is taxed at a maximum of 15% under subsection 302-145(2) ITAA 1997) when it is paid to a non-death benefits dependant.

Example

James is an accountant who has default life insurance coverage of $450,000 as part of his super. He has no death benefits dependants. If he died on his 31st birthday after having worked for his employer for 7 years (2,556 days) he would’ve had 34 years (12,419 days) to retirement. His super balance on his death is $50,000 including a $5,000 tax free component. His super fund claims a deduction for the life insurance premiums, meaning that the taxable component of the superannuation lump sums paid to non-death benefits dependant(s) would include an “element untaxed in the fund”.

The “element taxed in the fund” is calculated first under subsection 307-290(2) ITAA 1997. Assuming it is all paid to one person, the “element taxed in the fund” is calculated as:

($500,000 superannuation lump sum × (2,556 service days / 2,556 service days + 12,419 days to retirement)) – $5,000 tax free component = $80,342 “element taxed in the fund”

The “element untaxed in the fund” is then calculated under subsection 307-290(4) ITAA 1997 as the balance of the $495,000 taxable component (i.e. $495,000 taxable component – $80,342 “element taxed in the fund” = $414,658 “element untaxed in the fund”)

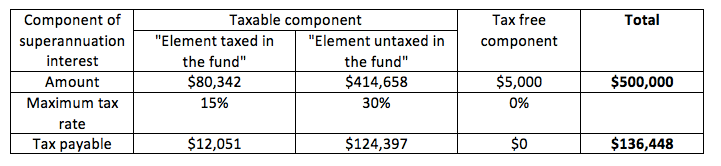

In summary, the tax payable on James’ superannuation interest if it was paid to a non-death benefits dependant is as follows:

*Note: There may also be Medicare Levy payable on the death benefit

Given the amount of tax payable, consideration should be given to holding the policy outside of superannuation (where the proceeds are generally tax free). Alternatively, James could have waited until he has death benefits dependants before he applies for life insurance through his superannuation fund. The problem with both of these options is that James will almost certainly have to provide evidence of health which is not generally required when you first become a member of a fund. If James had medical issues in the past that would prevent him from being insured, then it may be that he is better off taking the default coverage offered by the superannuation fund and accepting the tax payable.