From 1 July 2025, if legislated, a new tax—Division 296—will have application to individuals with a total superannuation balance (TSB) exceeding $3 million. This measure, which will need to be reintroduced into Federal Parliament due to the recent Federal Election, is designed to reduce the concessional tax treatment of superannuation earnings for high-balance individuals.

As tax agents, it’s essential to understand how this tax works and how it interacts with legacy pensions and reversionary pensions, which are common in older or estate-planning-focused superannuation strategies.

Who pays this new tax?

Division 296 tax is a liability raised to individuals who have two things: a TSB at the end of a year over $3m, and positive super earnings (including unrealised movement in asset values) in a given year. It is not charged to the super fund. The individual member can request that the super fund releases monies to them to assist with paying this tax.

There is a common misconception that a super fund can claim a credit later for the Div 296 tax previously paid by a fund member. This is not the case – a super fund will pay tax under the existing rules for any realised capital gains.

What Is Division 296 Tax?

Division 296 tax applies to taxable superannuation earnings—a calculated amount based on the growth in an individual’s TSB over a financial year, adjusted for contributions and withdrawals. If the TSB exceeds the $3 million threshold at the end of the year, a tax liability arises for that member based upon a deemed proportional share of the fund’s earnings. This liability is imposed at 15%.

Key features include:

- Applies from the 2025–26 income year.

- Negative earnings can be carried forward and offset against later year earnings.

- Exemptions exist for child recipients, structured settlements, and deceased individuals (in the year of death).

Legacy Pensions and Division 296

Legacy pensions—such as lifetime complying, life expectancy complying and market-linked income streams commenced before 20 September 2007—are often non-commutable and have unique valuation rules.

Recent reforms allow individuals to exit legacy pensions for a limited time (until 2029), converting them into more flexible products. However, for Division 296 purposes:

- The value of any commutated legacy pension (lifetime complying, life expectancy complying, legacy non-complying and market linked) is included in the TSB.

- It is important to determine the type of legacy pension as the valuation methodology does not align with the valuation method used for the TSB.

- Earnings attributed to these commutated pensions are included in the Division 296 earnings calculation unless the interest qualifies as a Division 296 excluded interest (e.g. certain judicial pensions or constitutionally protected funds).

This means clients with legacy pensions may face Division 296 implications unless they restructure or qualify for an exemption.

Reversionary Pensions and Division 296

A reversionary pension is a death benefit income stream that automatically continues to a nominated beneficiary upon the member’s death.

For Division 296:

- In the year of death of a person the reversionary pension balance is included in the TSB calculation of the surviving spouse. However, it would not be included in the spouse’s adjusted TSB in calculating the super earnings.

- If the beneficiary is a child recipient, they are exempt from Division 296 tax in the instance where at the end of each income year, they are considered an ‘excepted person’ in receiving such a pension per s296-20. This will apply until the child turns 25-year-old in respect of receiving such death benefit pension.

- The earnings on the reversionary pension are included in the Division 296 calculation unless the underlying interest is excluded (e.g. the pension is from a non-complying fund or constitutionally protected fund).

- Reversionary pension payments (withdrawals) from the deceased pension are also included in the beneficiary’s adjusted TSB in the year of withdrawal.

Importantly, if a reversionary pension is commuted and restarted, care must be taken to ensure it remains a death benefit pension to comply with superannuation standards.

Practical Example

Case Study:

- Jane has a TSB of $3.8 million as at 30 June 2026, including a $1.2 million reversionary pension received from her late spouse who died in the 2025 income year.

- Her superannuation earnings for the year are $200,000.

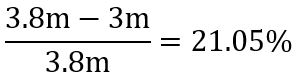

- The proportion of her balance above the $3 million threshold is:

- Her taxable super earnings are 21.05% × $200,000 = $42,100.

- Jane’s Division 296 tax liability for FY2026 is 15% × $42,100 = $6,315.

- If Jane were a child recipient (i.e. an excepted person), she would be exempt from this tax.

Final Thoughts for Tax Agents

Division 296 introduces a new layer of complexity for high-balance clients, especially those with legacy or reversionary pensions. Tax agents should:

- Review clients’ TSBs and pension structures.

- Consider whether legacy pensions should be exited under the transitional rules.

- Ensure reversionary pensions are correctly structured to maintain compliance and avoid unintended tax consequences.

Our team at Webb Martin Consulting have been actively advising clients with their Division 296 queries and strategic planning. If you or your clients need assistance navigating these changes, don’t hesitate to reach out to our team for assistance.

——-

![]()