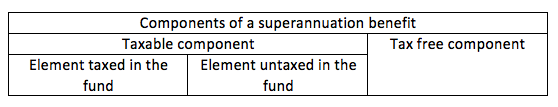

The complicated tax treatment of superannuation benefits that include a life insurance payout was discussed in an article in the February 2016 edition of The Assessment. As a refresher, a superannuation benefit consists of a tax free component and a taxable component (which is comprised of an element taxed in the fund and/or an element untaxed in the fund) which can be shown as follows:

It was explained that where the superannuation fund claimed a deduction for the cost of the life insurance premiums and was paid to a non-death benefits dependant, the death benefit included an element untaxed in the fund which is taxed at up to 30% (compared to up to 15% for the element taxed in the fund). The untaxed element is highest (and so the tax cost is larger) when the member is just starting out in the workforce and decreases as they draw nearer to retirement due to the formula in section 307-290(3).

Conversely, when it comes to superannuation disability benefits, the member gets a better tax outcome the younger they are when they are disabled. This is due to the method for calculating the tax free component of a superannuation disability benefit that is a lump sum in section 307-145 ITAA 1997. The formula in section 307-145(3) serves to increase the tax free component of the benefit and is essentially the opposite of the formula used for calculating the taxed and untaxed elements of a superannuation death benefit in relation to which a deduction for life insurance premiums have been claimed in section 307-290(3).

Example

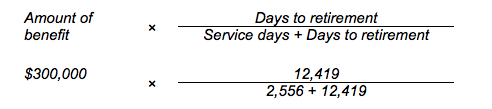

James is an accountant whose super fund has a Total and Permanent Disablement (TPD) insurance policy for $250,000. If he meets the requirements to receive a TPD benefit on his 31st birthday after having worked for his employer for 7 years (2,556 days) he would’ve had 34 years (12,419 days) to retirement. His super balance on this date is $50,000 including a $5,000 tax free component. Assuming he elects to receive the insurance payout as a lump sum, the tax free component of the superannuation benefit is increased in accordance with the formula in section 307-145(3) as follows: