The recent release of a trio of tax guidance documents by the ATO addressing section 100A (TR 2022/D1, PCG 2022/D1 and TA 2022/1), has caused quite the stir amongst advisors and their clients. Of key concern is the apparent retrospectivity in which the Commissioner’s views expressed in these documents could be applied.

It is commonly accepted that the Commissioner has an unlimited amendment period in relation to section 100A, which is reiterated on the ATO website which states that the “[ATO] have an unlimited period in which to make or amend an assessment under section 100A“.

However, a 2008 Full Federal Court decision, Metlife Insurance Limited v FCT [2008] FCAFC 167, (‘Metlife’) casts significant doubt on whether the Commissioner’s power to assess/amend in respect of section 100A is truly as uninhibited as the ATO contends. In this article we explore whether the Commissioner truly has an unlimited period of time to amend an assessment in relation to section 100A.

Commissioner’s power to amend

The Commissioner’s powers to amend assessments is contained in sections 170 and 170A of the Income Tax Assessment Act 1936 (‘the Act’). Of most relevance to section 100A is subsection 170(10), which provides (emphasis added):

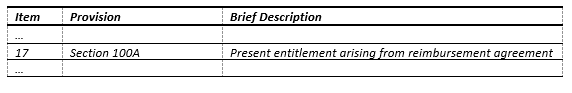

Nothing in this section prevents the amendment, at any time, of an assessment for the purpose of giving effect to any of the provisions of this Act set out in this table.

In addition to the above, the Commissioner may amend an assessment at any time if he is of the opinion there has been fraud or evasion.

The Metlife case

Metlife was concerned with the correct construction of subsection 170(10AA) and the extent of the Commissioner’s powers, afforded under that subsection, to amend an assessment at any time. Relevantly, subsection 170(10AA) read, at the time, as follows (emphasis added):

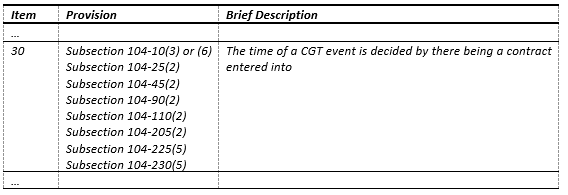

Nothing in this section prevents the amendment, at any time, of an assessment for the purpose of giving effect to any of the provisions of the Income Tax Assessment Act 1997 set out in this table.

The salient facts of Metlife are as follows, the taxpayer entered into a contract for the sale of a business during its 2001 income year. Settlement for the business sale occurred in the following year, but prior to lodgement of the taxpayer’s income tax return for the 2001 year. As settlement occurred prior to lodgement of the 2001 income tax return, the taxpayer included a capital gain in its 2001 income tax return in relation to the goodwill of the business, however in doing so the taxpayer took the position that a capital gain in relation to the sale of policy rights was exempt from CGT. Just over four years from the date of the deemed assessment for the 2001 income year and consequently outside the ordinary amendment period, the Commissioner issued a notice of amended assessment based on the view that the sale of the policy rights were not exempt from CGT.

The dispute eventually found its way to the Full Federal Court where the Commissioner argued that item 30 of subsection 170(10AA) empowered him to amend an assessment at any time in relation to a capital gain where the time of the event was determined by there being a contract entered into. The taxpayer argued that subsection 170(10AA) only empowered to the Commissioner to amend an assessment where settlement occurred subsequent to an assessment being issued in respect of the relevant income year.

In finding unanimously in favour of the taxpayer the Court stated that, in its view, the answer to the dispute turned on the meaning of the phrase “for the purpose of giving effect to“.

The Federal Court was of the view that just because an amendment took into account a CGT event or related to the consequences of a CGT event did not necessarily make it an amendment of an assessment “for the purposes of giving effect to” a provision of the 1997 Act set out in the table (para 20).

The Federal Court agreed with the taxpayer (at paragraph 24) that the mischief to which subsection 170(10AA) is directed is where a subsequent event retrospectively alters the taxable income of a taxpayer for an earlier year with the effect that the Commissioner may otherwise be prevented from amending the relevant assessment to give effect to the retrospective operation of the various sections contained in the table in that section.

The Court then went on to explain (at paragraph 27) that if Parliament had intended to create a provision that gave an indefinite power to amend an assessment where the entering into a contract determined the time of the CGT event, then Parliament would not have used the term “for the purpose of giving effect to” rather it could have used terms such as “concerned” or “related to ” or “included” when referring to the provisions set out in the table in subsection 170(10AA).

In the decision the Court also stated (at paras 28 and 29) that subsection 170(10AA) was not designed to allow for an oversight by the Commissioner but was designed to address new facts occurring after the original assessment, facts which could enliven provisions that operated with retrospectivity.

Application of Metcalfe to section 100A amendments under subsection 170(10)

As can be seen from the excerpts of section 170 above, the wording of both subsections 170(10) and 170(10AA) are, other than the reference to the particular act and the provisions listed in the table, identical. Based on the identical wording and given that both subsections are contained in the same section it is hard to see how the wording of subsection 170(10) could be interpreted differently to the interpretation of subsection 170(10AA) in Metlife. Therefore, Metlife provides a strong basis for the conclusion that the Commissioner may only amend an assessment under subsection 170(10) where new facts have occurred after an original assessment that have resulted in one of the provisions listed in the table (e.g. section 100A) to consequently apply with retrospect.

On the assumption that interpreting subsection 170(10) in such a manner is correct, then the Commissioner may only amend assessments under subsection 170(10), in respect of section 100A, where new facts have occurred subsequent to an original assessment, and he may not amend an assessment at any time merely because section 100A applies. In other words, without new facts occurring, the normal time limit on amending an assessment still applies.

Furthermore, as a reimbursement agreement must be entered into prior to a beneficiary being made presently entitled for section 100A to apply (explained in a recent newsletter article on the Guardian AIT case) and the fact that section 100A is self-executing (in that it does not require a determination by the Commissioner for it to apply) it is hard to envisage circumstances in which section 100A is triggered at a point in time other than when the present entitlement is conferred on the relevant beneficiary. Based on the Metlife case, it would appear that in most cases where section 100A applies, the Commissioner is restricted to the ordinary two/four-year amendment period.

We reiterate that although the Commissioner would in most cases of section 100A be prevented from making amending an assessment outside the two/four-year amendment period, the Commissioner would still be able to make an amended assessment at any time if he was of the opinion there has been fraud or evasion or to apply Part IVA of the Act.

No original assessment

Although, the above interpretation would preclude the Commissioner amending an assessment in respect of section 100A outside the ordinary two/four-year period in most cases. There is the glaring issue that many trustees will be in the position of not having been issued with an original notice of assessment by the Commissioner and therefore the clock has not begun ticking on the two/four-year amendment period. So, what are the options for trustees?

PS LA 2015/2

Due to the Commissioner’s practice of not issuing nil assessments to trustees and the inherent unfairness of such a practice, the ATO issued PS LA 2015/2.

PS LA 2015/2 provides instructions to tax officers to not issue original assessments to trustees outside the ordinary amendment periods unless:

- The trustee has not lodged a trust return for the year in question; or

- The Commissioner is of the opinion that there has been fraud or evasion;

- An extended or unlimited amendment period would apply;

- Where the time limit is extended due to a review or audit being commenced and the trustee agrees to extend the period.

Provided that the Commissioner adheres to the practices outlined in PS LA 2015/2, trustees who were not issued with an original assessment for an income year will still be protected by the general amendment periods. However, relying on PS LA 2015/2 does carry with it some risk as law administration practice statements are merely internal policy documents that are not binding on the Commissioner. Rather they merely protect taxpayers from shortfall interest and penalties provided that the taxpayer reasonably relied on the practice statement is reasonably relied in good faith.

If a taxpayer does not wish to rely on the Practice Statement, then there are other potential options.

Request an assessment

Under section 171 of the Act, where a taxpayer has lodged an income tax return and the Commissioner has not issued a notice of assessment within 12 months, the taxpayer may, in writing by registered post, requests that the Commissioner make an assessment. If the Commissioner does not issue a notice of assessment within three months of receiving the request, then any assessment issued after that date will be considered an amended assessment and for the purposes of determining whether an amended assessment may be made an original assessment will be deemed to have been made on the last day of the three-month period. The effect of this is that there is an incontrovertible start date for the amendment periods clock. Whilst this strategy does give trustees certainty that they are protected by the two/four-year amendment period, the strategy does have the negative effects of firstly, ‘restarting’ the amendment period for prior years, compared to if the trustee merely relied on PS LA 2015/2 and secondly, potentially drawing attention to the trustee, which could result in a review or audit being instigated.

Trustee assessment on a nominal amount

Although too late for prior income years, going forward a possible strategy may be for trustees to accumulate a nominal amount of trust income each year resulting in the trustee being assessed and paying tax under section 99A and the Commissioner issuing a notice of assessment, thereby uncontrovertibly starting the amendment period clock.

Conclusion

If the principle arising from the Metlife case applies to limit the amendment period for section 100A assessments, the outcome for trust taxpayers is subject to the Practice Statement.

Whilst both the Assistant Treasurer and Shadow Assistant Treasurer have announced that they will consider legislative amendment to address the retrospectivity concern, not all announcements of this nature always result in a change to the law. So until anything does occur taxpayers remain at risk. For the current and future tax years, trustees and their advisors should also consider whether any of the above strategies should be implemented to assist in reducing their section 100A risk going forward.

—–

![]()

Found this article insightful? Subscribe to our newsletter “The Assessment” and receive more articles like this every month!

![]()

Need more advice? Contact us via email or on 03 8662 3200