This article was originally published on 24 November 2016, and updated July 2023.

It is reasonably common for consultants and contractors providing services to seek reimbursement for costs, such as travel expenses, in addition to the charge for services. However, the GST treatment of such reimbursements depends on the arrangements entered into between the Contractor and the Customer, and such arrangements may be shown in different ways on the tax invoice.

Despite the GST regime being in place for over 20 years, this continues to be an interesting issue. Why? It is probably because the GST implications depend on both commercial issues and GST technical interpretation.

As with most GST matters, it is important to understand and clarify the facts and circumstances of each case, which generally means understanding the commercial terms of the transaction. In this article we have set out some examples of the typical different transactions that arise and the GST implications of such arrangements.

What have the parties agreed?

With consultants/contractors, the GST treatment will depend on what has been agreed between them (the Contractor) and the Customer. The net effect may be the same but the underlying basis may differ. This is best dealt with via illustrative examples.

Base Example Facts

Assume a Contractor is engaged to perform two days services on site for a Customer. Broadly the arrangement could be that the Contractor is entitled to charge $1,100 per day including GST, plus travel and accommodation costs will be covered. The daily fee is relatively uncontroversial, but it is the travel and accommodation components that may give rise to different GST treatments. In this analysis, let’s assume the travel costs comprise an airfare at $440 inclusive of GST and accommodation at $660 inclusive of GST.

By way of example, the following scenarios could arise:

- the Contractor provides a fixed fee quote of $3,300 inclusive of GST;

- the Contractor provides a fee quote as follows:

‘For consulting services, two days at $1,100 per day = $2,200 (including GST), plus reimbursement of travel and accommodation costs as incurred. Costs estimated as airfare $440 (incl GST) and accommodation $660 (incl GST).’

- the Contractor provides a fee quote as follows:

‘For consulting services, two days on-site at $1,100 per day = $2,200 (including GST). The daily rate does not include travel costs which are to be paid over and above the daily rate. Such costs are to be as agreed between the parties. The Contractor acknowledges that where it incurs such costs it is doing so as agent for the Customer and will provide the Customer with copies of the tax invoices by way of substantiation.’

Under the first and second scenarios the Contractor appears to be acting in its own capacity when providing the services including the travel and accommodation. That is, the Contractor is acting as the principal in the transaction. In these circumstances, typically the consultant is also able to choose his/her own airline and accommodation venue.

Under the third scenario, the Contractor would be acting it is own capacity (principal) when providing the services but would be acting as agent for the Customer with regard to the costs.

Principal vs Agent

The ATO has set out its view of principals and agents in its public ruling GSTR 2000/37 (originally issued on 13 December 2000, but updated numerous times since then, most recently as at 20 March 2019).

Broadly, if a principal makes a supply through an agent the GST liability rests with the principal and not the agent. Similarly, if an agent makes an acquisition on behalf of a principal, the input tax credit (ITC) entitlement arises to the principal and not the agent.

With an acquisition made by an agent, while the tax invoice may be made out in the agent’s name this still meets the tax invoice requirements, but the ITC is to be claimed by the principal and not the agent.

In addition to setting out the GST implications on transactions involving agents, GSTR 2000/37 also makes the following specific comments (in paragraph 27) regarding agents and reimbursements of expenses:

’27. An agent may incur an expense (for example, motor vehicle expenses) in connection with the carrying on of your enterprise. If you reimburse the agent for that expense, you may be entitled to claim an input tax credit for the reimbursement under Division 111. Section 111-5 allows a principal to claim an input tax credit on a reimbursement made to the agent for an acquisition (being a taxable supply of the supplier) made by the agent while the agent was acting on the principal’s behalf. This entitlement exists even though the requirements of section 11-5 (which is about what is a creditable acquisition) are not met.’

Illustrative Examples

Below are some illustrative scenarios representing typical transactions that may be entered into commercially, highlighting the different treatments that may arise for cost reimbursements. Each scenario corresponds to the fee quotes/estimates referred to earlier.

Scenario 1

Under this scenario the Contractor is acting in its own capacity and not as agent. Therefore, the travel and accommodation costs are incurred by the Contractor and, provided the acquisition has been made for a creditable purpose and the Contractor holds a valid tax invoice, the Contractor would be entitled to claim ITCs for those costs. Assuming the costs are as referred to above, the Contractor would be entitled to claim $100 as an ITC ($40 for the airfare and $60 for the accommodation). The cost to the Contractor for the airfare and accommodation net of ITCs would be $1,000.

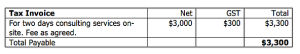

The Contractor is also invoicing the Customer in its own capacity. Practically, we expect the Contractor would issue an invoice along the following lines:

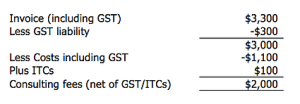

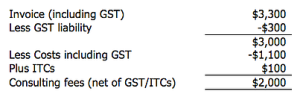

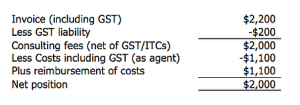

Accordingly, the Contractor would have a GST liability of $300 (being 1/11th of the $3,300). The net position for the Contractor would be as follows:

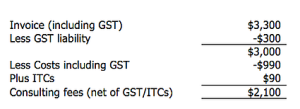

Under this scenario if, for example, the Contractor was only required to pay $330 for the airfare this would not change the amount invoiced to the Customer (as the arrangement if for a fixed agreed fee). However, this would decrease the costs of the Contractor and increase their profit, as per below:

Scenario 2

Under this scenario the Contractor is also acting in its own capacity and not as agent (as in Scenario 1). Therefore, the travel and accommodation costs are incurred by the Contractor and, provided the acquisition has been made for a creditable purpose and the Contractor holds a valid tax invoice, the Contractor would be entitled to claim ITCs for those costs. Assuming the costs are as referred to above, the Contractor would be entitled to claim $100 as an ITC ($40 for the airfare and $60 for the accommodation). The cost to the Contractor for the airfare and accommodation net of ITCs would be $1,000.

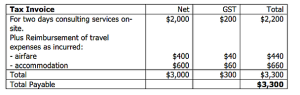

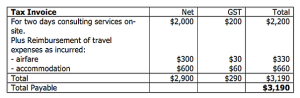

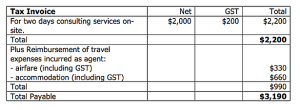

The Contractor is also invoicing the Customer in its own capacity. Accordingly, the Contractor would have a GST liability of $300 (being 1/11th of the $3,300). Practically, we expect the Contractor would issue an invoice along the following lines:

Note, as the Contractor would be entitled to an ITC for the costs incurred, when invoicing the Customer, the Contractor will be liable for GST and so needs to add GST to the cost reimbursements (as shown above). Accordingly, the Contractor would have a total GST liability of $300 (being 1/11th of the total amount ($3,300) invoiced to the Customer). The net position for the Contractor would be as follows:

Under this scenario if, for example, the Contractor was only required to pay $330 for the airfare this would change the amount invoiced to the Customer as the arrangement is for reimbursement of costs ‘as incurred’. The invoice would reflect this as follows:

However, the Contractor’s net position under this scenario does not change:

Scenario 3

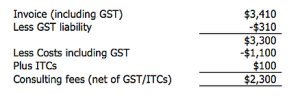

Under this scenario the Contractor is also acting in its own capacity for the supply of services but is acting as agent for the travel expenses. Therefore, while the travel and accommodation costs may initially be paid for by the Contractor they are done so on behalf of the Customer. Provided these acquisitions are made for a creditable purpose and a valid tax invoice has been issued, the Customer would be entitled to claim ITCs for those costs. (Note: the Contractor is not entitled to claim any ITCs for these costs, as it is making these acquisitions on behalf of (as agent for) the Customer.) Assuming the costs are as referred to above, and noting that the Contractor is invoicing the Customer in its own capacity only for the services component, we expect the Contractor invoice and net position would be as follows:

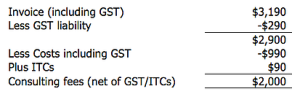

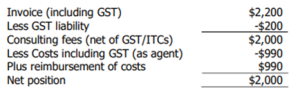

Accordingly, the Contractor would have a GST liability of $200 (being 1/11th of the $2,200). The net position for the Contractor would be as follows:

Under this scenario if, for example, the Contractor was only required to pay $330 for the airfare this would change the amount invoiced to the Customer. The invoice would be as follows:

However, unlike Scenario 1, the Contractor’s net position does not change:

GST on GST?

Finally, below is an example of a situation that may arise where Contractors may seek reimbursement of expenses on a ‘plus GST’ basis.

Scenario 4

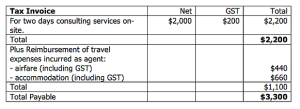

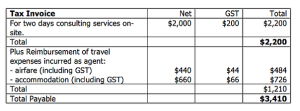

This scenario is the same as Scenario 2 except that the Contractor seeks to recover the expenses on a ‘plus GST’ basis. That is, while the Contractor incurs the GST inclusive airfare of $440 (and the GST inclusive accommodation of $660) the Contractor seeks to recover from the Customer $440 plus 10% GST for the airfare and $660 plus 10% GST for the accommodation. By way of example, the Contractor’s invoice may reflect this as follows:

If this was the arrangement agreed to between the Contractor and the Customer, the expenses are effectively being marked up by 10%. If so, the net result would be as follows for the Contractor:

It would be rare for the parties to agree to invoice on this basis. Assuming they haven’t the example invoice above would be incorrect as the Contractor would be seeking to apply GST on the GST-inclusive amount of the expenses, rather than the Contractor reducing their cost to the extent they are entitled to a GST credit for the costs of the airfare and accommodation, and then applying GST.

Conclusion

The above highlights the need to understand the underlying facts and terms of each transaction, as these often shape and determine the GST implications. This is particularly the case where reimbursements are involved.

Also, it is not always obvious where an agency relationship exists. Again, however, understanding the nature of such relationships allows the GST implications to be determined.

—– –

![]()

Found this article insightful? Subscribe to our newsletter “The Assessment” and receive more articles like this every month!

![]()

Need more advice? Contact us via email or on 03 8662 3200