Practitioners should be familiar with the Division 7A integrity rules. They often have a key part to play, assisting in the process of ensuring loans made by a private company to a shareholder or their associate are Division 7A compliant.

Division 7A also extends to payments and debt forgiveness by a private company in favour of their shareholder or associate and includes certain trustee payments, loans, and debt forgiveness.

Non-compliance as we all know can be costly, as any Division 7A deemed dividends are not frankable even though they are taken to be paid out of the private company’s profits.

Who is an associate?

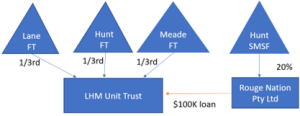

Division 7A is enlivened only if the loan is to a shareholder or their associate. The degree of complexity increases where the associate relationship between a shareholder of a private company and the borrowing entity cannot be easily determined at first instance. This is best illustrated by the following example scenario:

Mum and Dad are the only members of the Hunt SMSF as well as being potential beneficiaries of Hunt FT. The unitholders of LHM Unit Trust are discretionary trusts and they are not related in any way other than through their business association. None of the unitholders are shareholders of Rouge Nation Pty Ltd. The other shareholders of Rouge Nation Pty Ltd are non-related parties (i.e. the Hunts are not related to those other shareholders).

For FY2023 Rouge Nation Pty Ltd provided a loan to LHM Unit Trust for working capital purposes. Based on the ownership structure of both the lender and the borrower, in first instance LHM Unit Trust and Rouge Nation Pty Ltd would appear not to be ordinarily considered as part of any unitholders ‘family group’ due to a lack of sufficient control or influence.

Is LHM Unit Trust an associate of Hunt SMSF?

For Division 7A to apply it is necessary to establish whether there is an associate relationship between any of the trusts and Hunt SMSF.

Section 318 ITAA 1936 defines the relationships which will result in an entity being an associate of another. Whilst this definition of associate is contained in the controlled foreign companies rules, it is generally used for the purposes of the Income Tax Assessment Act including Division 7A.

Associate of a trust

The definition of ‘associate’ is broad in scope, notably for a trust. Broadly, an associate of a trust includes an entity that benefits or is capable of benefiting (whether by exercise of a power of appointment or otherwise) under the trust, either directly, or indirectly through any interposed companies, partnerships or trusts. This implies a look-through approach.

The associate rules, for a trust, also extends to include entities that are classed as an associate (under the relevant associate rules) of the entity that benefits under the trust.

The breath of when an entity qualifies as an associate of a trust can be contrasted with the SBCGT concessions connected entity rules. For a trust (other than a discretionary trust) it is based on the concept of controlling interest (being 40% or more). For a discretionary trust it is based on control or significant influence.

There is no such benchmark for the associate rules for a trust as outlined above. In the absence of a ‘controlling’ benchmark all potential beneficiaries are capable of being associates of the underlying trust from which they could benefit from (whether directly or indirectly through interposed entities). This means in the context of the above example scenario, Mum and Dad as members of the Hunt SMSF are associates of that super fund as well as being associates of Hunt FT (keeping in mind that a super fund is fundamentally a type of trust). Similarly, under the look through approach Mum and Dad would also be associates of LHM Unit Trust (via Hunt FT’s unitholdings).

Whilst Mum and Dad are associates of LHM Unit Trust the inverse may not be true unless LHM Unit Trust is classed as an associate of Mum or Dad under the associate rules for an individual.

Associate of an individual

The associate rules for an individual include relatives i.e., parents, grandparents, brothers, sisters, i.e., parents, grandparents, brothers, sisters, uncles, aunts, nephews, nieces, lineal descendants or adopted child/children of that individual, the spouse of the individual and the spouse of any persons mentioned above

The associate rules also extend to include a trust where the individual or an associate of that individual benefits or is capable of benefiting under that trust.

As Mum and Dad are capable of benefiting under LHM Unit Trust (via Hunt FT’s unitholdings). LHM Unit Trust is therefore an associate of the individuals, and by extension it is also an associate of Hunt SMSF under the above associate rules for a trust.

Accordingly, the $100K loan made by Rouge Nation Pty Ltd to LHM Unit Trust will be subject to Division 7A. The risk of non-compliance is that the unitholders could be taxed on their share of the $100K deemed dividend in FY2023, even though the loan was not from a company that they own or control. There may also be flow on consequences for the Hunt SMSF, although these are outside the scope of this article.

Where to from here?

The above example scenario illustrates that loans from a private company to entities that otherwise would not ordinarily be considered to be part of a shareholder ‘family group’ (because of a lack of control or significant influence) may on closer examination fall within the scope of Division 7A. Given the broad definition of associate, it is necessary for practitioners to review all loans made by their private company clients so as to identify potential Division 7A issues.

—–

![]()

Found this article insightful? Subscribe to our newsletter “The Assessment” and receive more articles like this every month!

![]()

Need more advice? Contact us via email or on 03 8662 3200